Billions of Dollars are Pouring into M&As and Buyouts in an Already Overheated Market. Think’s Jeff Musgrove Worries if the Pace is Sustainable

BY BILL ATKINSON, CEO AT ATKINSON STRATEGIC COMMUNICATIONS ON MARCH 29, 2021

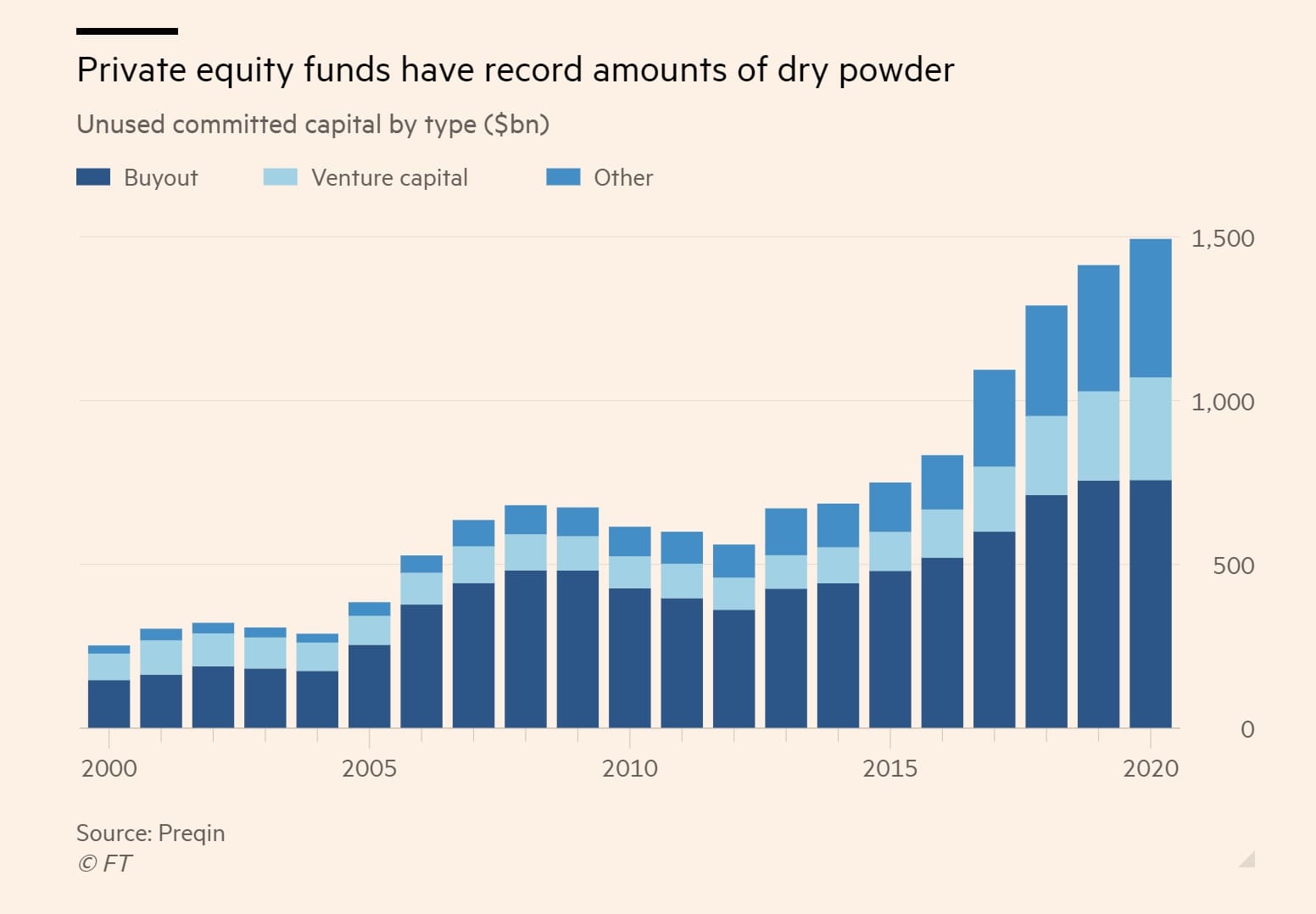

Thirty-two years in the financial services industry and Jeffrey Musgrove has never before seen private equity firms awash in so much capital – $2.5 trillion before the pandemic even began.

Deal making seized up last spring but now the floodgates are opened for buyouts, M&As and a newly popular financial vehicle, the SPAC. Billions are already being put to work. Goodyear Tire & Rubber Co., for example, agreed to acquire Cooper Tire & Rubber Co. in a $2.8 billion deal in February. Blackstone Partners and Starwood Capital are paying $6 billion for Extended Stay America hotel brand. And investors are diving headlong into SPACs. Also called “blank-check companies” SPACs raise money by listing on a stock exchange and then finding a merger partner that will take them public.

Rapper and businessman Jay-Z, former NFL football player Colin Kaepernick, professional tennis star Serena Williams and NBA Hall of Famer Shaquille O’Neal are either sponsoring their own SPAC or on the boards of SPACs. In the meantime, the Securities and Exchange Commission has warned investors not to invest in SPACs just because a sports or movie star says it’s a solid investment.

Warren Buffett and his partner Charlie Munger fret about a frothy market and are cautious. Munger sees SPACs as “crazy speculation” and an “irritating bubble.”

Meantime, the pressure is growing on executives at small and mid-size business to do deals. Musgrove, who is Managing Director of Executive Advisory and PE & Venture Support at Think, is advising clients to block out the noise, develop a strategic acquisition plan and don’t be afraid to employ the Buffett/Munger strategy and walk away from a deal when it doesn’t sit right.

We spent a few minutes with Jeff to find out what he is telling clients and how this all could play out.

Q. Have you ever seen anything like this?

A. It’s just such an unprecedented time. There’s so many opportunities, but there’s so much competition at the same time. I had a call with a local VC firm and I was talking about the work we are doing at Think around due diligence for VC firms and he said the VC market right now is so overheated that he equated it to the housing market- people are buying sight unseen! So, he told me that these companies raising money have so many VC suitors that they are not even giving folks time to do any due diligence. You either put the money in or they go to the next VC. That is hard to get your mind around if you think of the size of the checks these VCs are writing.

Q. What is your advice to clients?

A. You need a plan. If you’re a company and you got your strategy which includes acquisitions as part of inorganic growth, you know the number of competitors is growing in terms of who else may be trying to buy that business. The importance of strategy now is even bigger, you have so many opportunities, but you’ve got to figure out how to pick the target without over paying. You’ve got competition coming from everywhere.

Q. Are Think’s clients focused on acquisitions?

A. Our clients tend to be a mix. We have some companies that are really working on their strategy and they want to grow. Some of it is through acquisition some of it is through creating new business lines. Others are not going out and acquiring they’re creating their own from scratch. It really is kind of where you are as a company in terms of the mix of organic and inorganic growth you are trying to drive.

Q. How important is discipline when you see so much excitement in the market?

A. It’s key. I will tell you we are starting to do a lot of work with our clients, and they are becoming more aggressive in wanting to grow. One of the things that we spend a lot of time on is the discipline that’s needed to have a strategic plan. And the discipline to stick to that strategic plan and not chase the shiny object and potentially over pay for the shiny object that may not be in line with the roadmap.

Q. Is that a lot to ask in a frothy market?

A. For sure, but a bad transaction will come back to haunt you. We’re doing a lot of work with our clients saying,. Let’s take a look at your strategic plan and take a look at how the world has changed and what opportunities that it gives us to potentially tweak the plan to take advantage of the current environment.” I say this all the time, “adjacencies, adjacencies, adjacencies.” It’s thinking about your business and then what is it that is a natural expansion of your business or add onto your business that’s there. People now need to understand the new world and bake it into a strategy and their roadmap.

Q. And I suppose they have to keep an eye out for the PE firms which can change the dynamics of a deal in a heartbeat.

A. When you put a bid in you have to be aware that in the last couple of years private equity teams are banding together and can be almost impossible to compete against. Their checkbook in theory is a gazillion dollars, and if you’re a corporation trying to do the deal, you don’t have a gazillion dollars and you’re not going to lever the way they levered. Also, on the PE side, they are trying to take advantage of a beaten down company hurt by COVID but poised to rebound. Blackstone Partners and Starwood Capital are paying $6 billion for Extended Stay America.

Q. What are your expectations in the months to come?

A. This is an opportunity for a lot of companies to do some consolidation. So that’s one thing that you’re going to see. The part that quite frankly I worry about is the number of PE deals getting done because the history of PE acquisitions often does not end well for the employees of the acquired company. I will be very interested to see if the allure of the SPACs starts to dim as data shows that these are not good investments for the investor post-merger.

Q. That doesn’t sound good. Walk me through one of these PE transactions.

A. It’s pretty simple. They essentially go after companies that have good cash flow and if they’re distressed even better because they can buy them low. And it’s no secret the PE guys take the cash flow, slash costs, and lever on debt. The first thing they do is pay themselves back. You don’t hear about that; what you hear many times is companies going bankrupt after being bought by PE. Many times these were good companies who were in strong financial position before the sale. I’m afraid, this is going to be one of the side stories in this. It’s the rise of private equity buying which could lead to an increase in companies failing because of the private equity model versus the more traditional merger and acquisitions between competitors or other companies.

Q. What is driving all of this activity? Low interest rates? Tax rates? Pent up demand from the pandemic? Hype?

A. I’ve been the guy who’s saying for a year there’s been absolutely no correlation between the market and what’s actually going on. The market never acknowledged Covid-19.The market went up during the Capitol Hill riots, which one could think would be impossible. At this point it’s really hard to say. Generally, though, people are looking and saying, “I’m still not going to be able to get the return in the market that I can,” and go the private equity or venture capital route. So, interest rates are low, there’s some growth in the market, but a lot of people think it is the perfect setup to allow people to have all of this dry powder. The hard part is deciding how to use the dry powder. The harder part is how do you use it without overpaying?

Q. Where is all of this heading?

A. A lot of people think that the market is bound for some kind of correction. So, the equities, you look at that and you say, ‘You know what? I don’t know if that’s the place. ’What do you do? You go into private equity funds because that’s where you think the returns are. And by the way more and more of these pension funds are going in, too.

Q. Or you follow the stars and plunk your money into a SPAC, right?

A. Now you have celebrities creating SPACs. It just shows you people obviously have nothing else to do with their money except put it into a blank check company run by a celebrity. By combining with a SPAC means that a company being acquired doesn’t have to go through all the roadshows and present before investors. I mean, counterintuitive in many ways.

Q. When all is said and done, the key for all small and mid-size business executives is to stay true to your plan and be discipline.

A. You’ve got to hold to your discipline; you’ve got to be willing at some point to say, “I’m not doing this deal at this valuation. I’m just not going to do it.” And that’s not a very popular thing, that’s what you need to balance. You need to balance the desire for growth and the willingness to be aggressive to grow with the discipline to not make a mistake in terms of where you spend your money or how much money you spend that could jeopardize the future.